More About Scj Cooper Realtors

The smart Trick of Scj Cooper Realtors That Nobody is Discussing

Table of ContentsSome Known Facts About Scj Cooper Realtors.Excitement About Scj Cooper RealtorsScj Cooper Realtors Things To Know Before You BuySome Ideas on Scj Cooper Realtors You Should Know

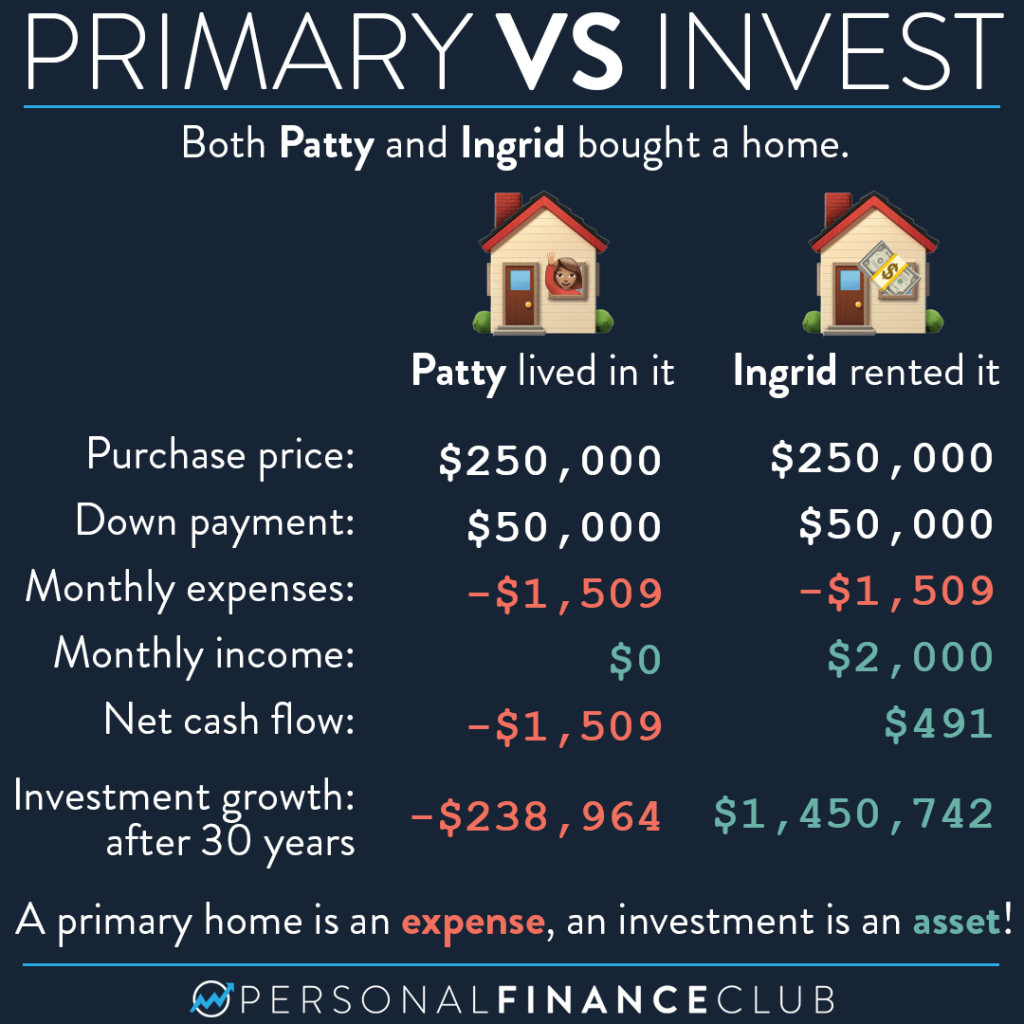

For comparison, Wealthfront's ordinary profile gained simply under 8% net of costs over the past 8 years. As well as the Wealthfront return is much more tax obligation reliable than the return you would certainly get on property due to the means rewards on your Wealthfront profile are tired as well as our tax-loss harvesting - scj cooper realtors.1% return, you need to have a nose for the neighborhoods that are most likely to value most quickly and/or find a terribly mispriced residential or commercial property to get (into which you can invest a small quantity of money and upgrade into something that can command a much higher rent even much better if you can do the work on your own, however you require to see to it you are being effectively made up for that time).

As well as we're discussing people who have large staffs to assist them locate the optimal home as well as make enhancements. scj cooper realtors. It's much better to diversify your investments You need to consider purchasing an individual residential property the very same way you ought to think of an investment in an individual supply: as a big risk.

The suggestion of attempting to select the "right" specific residential property is alluring, specifically when you believe you can obtain a bargain or get it with a great deal of leverage. That method can function well in an up market. 2008 showed all of us regarding the risks of an undiversified actual estate profile, and also reminded us that utilize can work both methods.

Scj Cooper Realtors Fundamentals Explained

Liquidity matters The last significant debate against owning investment residential or commercial properties is liquidity. Unlike a realty index fund, you can not offer your building whenever you want. It can be difficult to predict the length of time it will certainly take for a residential building to sell (and also it often seems like the more excited you are to market, the longer it takes).

Trying to make 3% to 5% greater than you would on your index fund is almost difficult besides a handful of actual estate personal equity investors who bring in the finest and the brightest to do nothing but concentrate on outperforming the marketplace. Do you truly believe you can do it when specialists can't? Our suggestions on rental building investing is consistent with what we suggest on other non-index investments like stock picking and also angel investing: if you're mosting likely to do it, treat it as your "funny money" and also limit it to 10% of your liquid internet worth (as we explain in Sizing Up Your House As An Investment, you need to not treat your residence as a financial investment, so you do not have to limit your equity in it to 10% of your liquid net well worth).

However, if you own a building that leases for less than your lugging cost, after that I would strongly urge you to think about selling the property and instead purchase a diversified portfolio of low-priced index funds.

Some individuals pick to acquire a home to lease out on a long-term basis, while others go for short-term leasings for visitors as well as service tourists. From apartments, single-family residences, and penthouses to commercial workplaces as well as retail areas, the city has a vast variety of residential or commercial properties for budding investors.

How Scj Cooper Realtors can Save You Time, Stress, and Money.

So, is Las Las vega property a good investment? Allow's explore! Why Las Vegas is a Great Area to Invest in Real Estate, A great deal of individuals are transferring to Las Las vega whether it's due to the amazing weather, no revenue tax obligations, and also a terrific cost of living. That's why the city is constantly ending up being a leading property financial investment destination.

/real-estate-vs-stocks-which-is-the-better-investment-357992_final-68cce93ae0e8483395d1e7c47368e8b5.png)

Las Las vega is known for its business conventions and profession programs that it organizes annually. These generate service vacationers as well as business owners from all profession who, once more, will certainly be looking for someplace to remain. Having a property home in the area will certainly be scjcooperrealtors.com beneficial for them as well as make returns for you.

You can expect a steady stream of people looking to lease out purchase, even your Las Las vega real estate investment. What to Seek in an Excellent Financial Investment Building, Purchasing realty is a significant life choice. To identify if such an investment benefits you, be sure to think about these important factors.

Examine This Report about Scj Cooper Realtors

They can give you a suggestion of what's in shop in the area, so you can better examine if this is an excellent investment. Residential Or Commercial Property Value, Recognizing the approximated value of the residential or commercial property in development aids you choose whether or not the financial investment is worth it.